2023 Engineering Salary Expectations Trends Report

Introduction

As the tech industry faces the ongoing challenges of mass layoffs, a saturated job market, and tightening resources, workers have felt the repercussions in the form of lower earning potential. Over 200,000 employees across nearly 700 tech companies have already been laid off, with more being announced every day. While this presents obvious hardships on both sides, there are emerging benefits that will have a lasting impact on the state of hiring and being hired.

The current market undoubtedly opens new avenues for employers, who now have the opportunity to attract top-quality candidates at a reduced cost, with a larger pool of applicants and more options to choose from than ever before. Meanwhile, candidates are now emphasizing culture, career growth, work-life balance, and stability in ways we’ve never seen before. As the economy and the tech industry rebound and salaries begin to increase again, candidates will continue to place equal or more importance on these non-monetary benefits.

This report focuses primarily on the impact of minimum salary requirement trends on software engineers, which have long been among the most highly compensated and in-demand roles in the industry.

Key Findings

- The state of the job market is the leading reason that engineers are lowering their salary expectations, but there is a newly heightened emphasis on non-monetary benefits, like career growth, work-life balance, and company culture.

- Mid-level engineers are reducing their salary requirements more significantly than their entry- and senior-level peers, likely due to an oversupply of mid-level talent in the current market.

- Engineers in top tech hubs earn higher salaries than those in other metros, but their salary expectations have fallen more significantly.

- The gender pay gap is still a big problem for mid- and senior-level female engineers. However, newly-minted engineers have comparable salary expectations that have decreased at a similar rate for both men and women.

Redefining Job Priorities in a Tumultuous Landscape

56% of tech workers would accept equal or less pay in a new role.

— Blind April 2023 survey

The Job Market is the Leading Factor in Lowered Salary Expectations

A recent survey of the Blind community reveals that 56% of tech workers are open to accepting the same or lower pay in a new role—provided the role fulfills another unmet need.

Job-Seekers are Primarily Influenced by Current Market Conditions

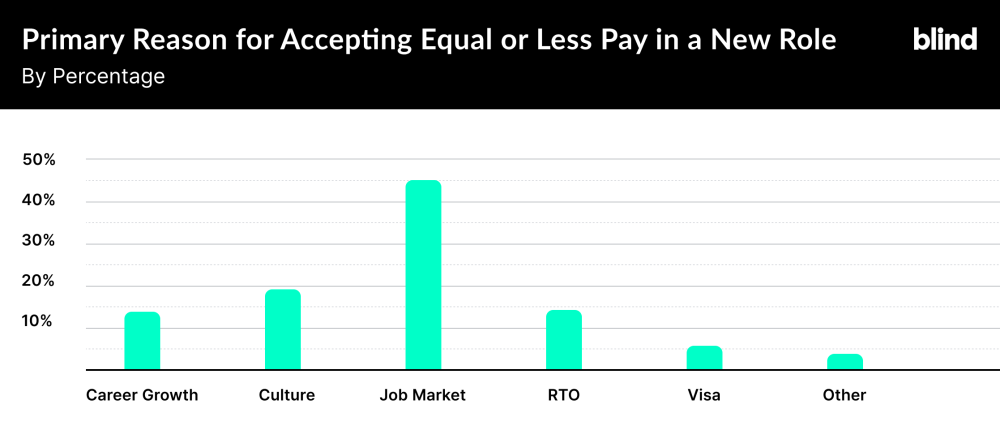

This finding underlines the significant influence of current job market conditions on salary expectations, with 45% of respondents citing this as the primary reason they would accept a comparable or lower salary for a new position.

The Market Is the Primary Influence, but Not the Only Influence

While the current market and layoffs are the primary drivers, the survey reveals there is also a shift in the priorities of tech professionals, as many are now willing to trade monetary compensation for other factors that contribute to their overall job satisfaction and well-being.

I’d rather make less money and be happier.

— Anonymous, verified Meta employee on Blind

I would trade toxicity for a lower paycheck.

— Anonymous, verified Salesforce employee on Blind

Survey respondents cited several reasons for their willingness to accept lower salaries: 19% considered a strong company culture and work-life balance to be critical drivers of their decision-making process. 14% expressed a preference for remote or hybrid work, indicating that the flexibility provided by flexible work setups is highly valued. Meanwhile, 13% emphasized the importance of career growth opportunities.

Dave Carhart, Lattice’s VP of People Strategy Group keenly observes that, “This reinforces that compensation doesn’t exist in a vacuum, but rather as one part of a larger value proposition. Career growth, culture, and flexibility are major motivators for employees. They are often the drivers not only of decisions to join or leave companies, but also what compensation to accept.”

Implications for Employers and Jobseekers

Employers now have a unique opportunity to deliver on needs outside of compensation to hire highly qualified candidates at a potentially lower cost. Historically resource-constrained startups and smaller companies with limited budgets may stand to benefit the most here.

While job-seekers may need to be more flexible around compensation, it’s important to note that this shift is not solely a sacrifice. As more companies embrace outcome-focused cultures, remote work arrangements, and flexible hours, employees stand to gain improved work-life balance, a more nurturing company culture, and other non-monetary benefits that contribute to their overall well-being.

The high TC (total compensation) companies are in layoff mode, and their culture is a dumpster fire.

— An anonymous, verified Meta employee on Blind

See candidates’ minimum salary requirements upfront. Hire with Talent by Blind.

The Job Market’s Impact on Engineers by Level

Across the board, tech workers with two to five years of experience have dropped their salary requirements the most drastically, followed closely by those in the five to 10-year bracket.

Early-Career Engineers Are Least Affected by Market Conditions, While Mid-Level Talent Bears the Brunt

In this report, the following definitions are used:

- Entry-Level – 0 to 2 years of experience

- Junior – 2 to 5 years of experience

- Mid-Level – 5 to 10 years of experience

- Senior – 10+ years of experience

Salary Expectations Across Levels of Experience Have Dipped

Junior and Mid-Level Engineers Are Lowering Salary Expectations at a Higher Rate

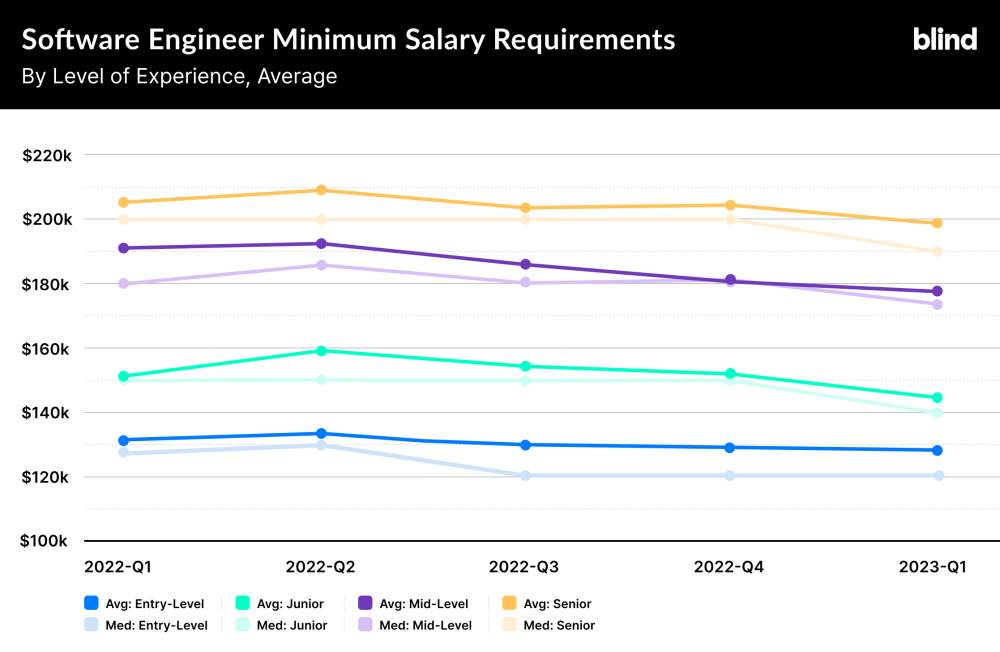

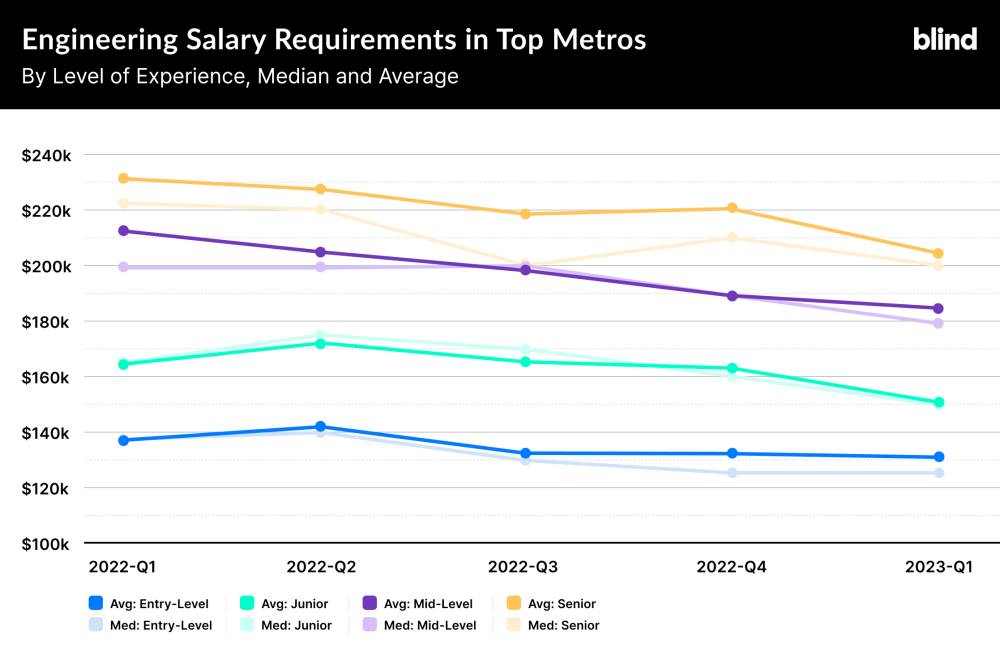

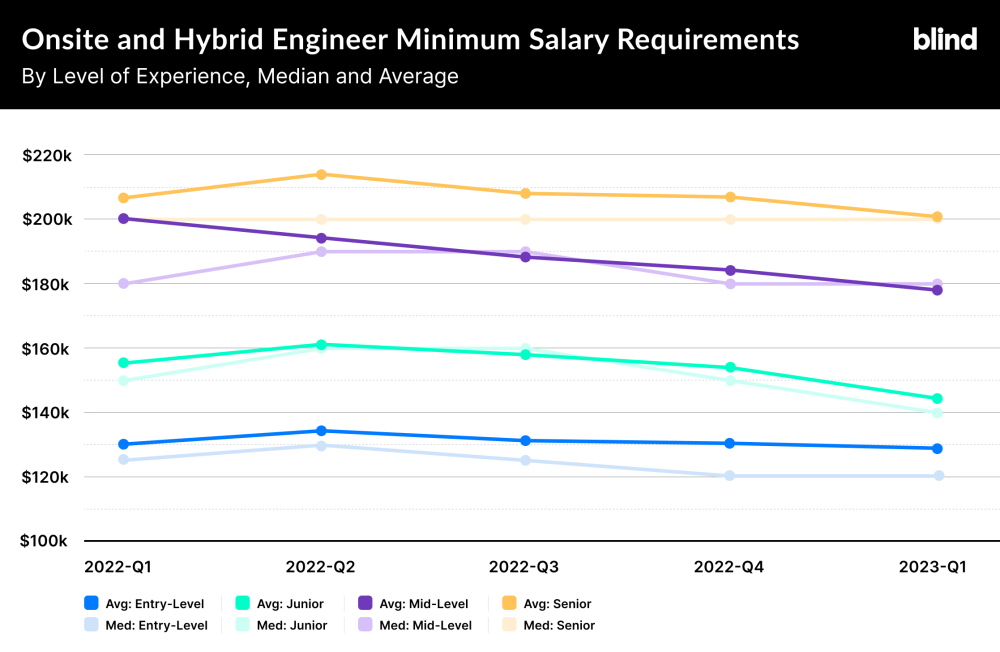

Back when the market was still hot, there was an increase in median and average salaries for engineers of all levels from Q1’22 to Q2’22. However, as the market began to decline thereafter, junior tech employees, or engineers with two to five years of experience, have since lowered their salary requirements most significantly, at 10%, closely followed by those in the five to 10-year bracket at 8%.

There are a few possible explanations for this: There may be an oversupply of mid-level talent in the market, especially those who have been impacted by layoffs and are therefore vying for roles that have become relatively scarce. Alternatively, it’s possible that mid-level software engineers had previously experienced a higher salary inflation rate than other levels, and now salaries for this group are adjusting accordingly.

Senior Talent Is Also Adjusting Expectations… but Less

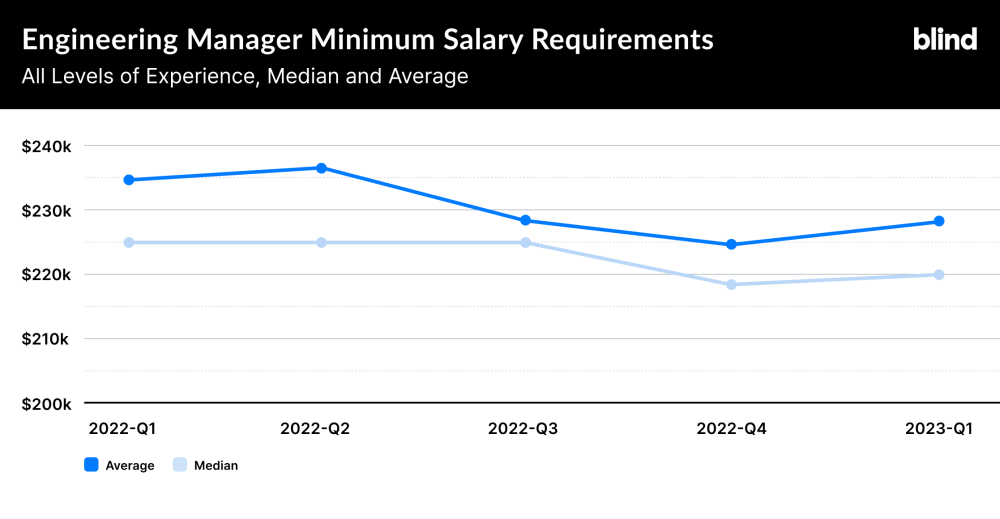

More experienced tech workers, such as engineering managers, who often possess more highly specialized skills and a more robust resume, only saw an average salary drop of 3% year-over-year, compared to the general average of 5%.

Salary Requirements for Senior Engineering Talent are Less Influenced by Market Conditions

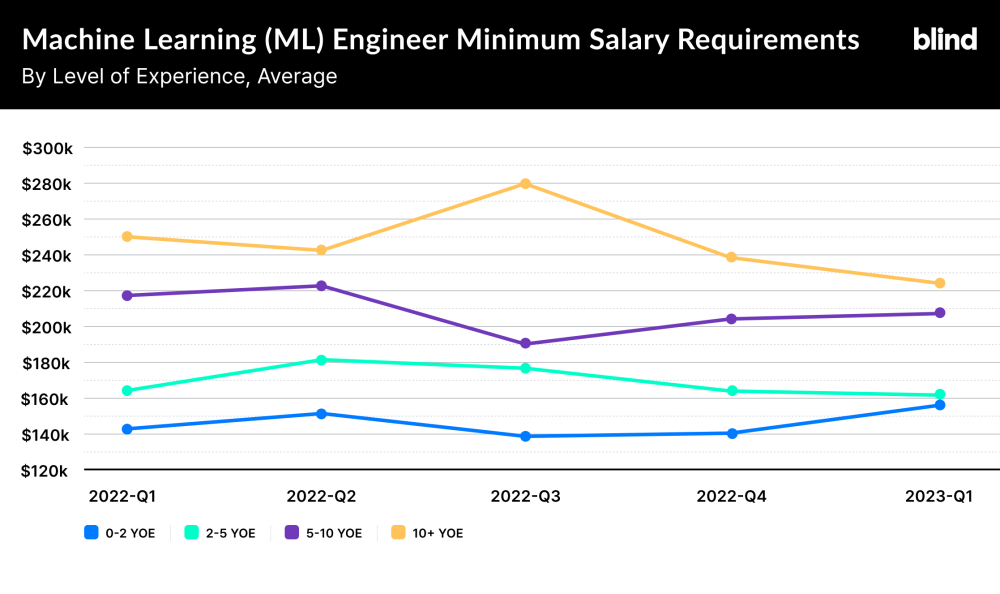

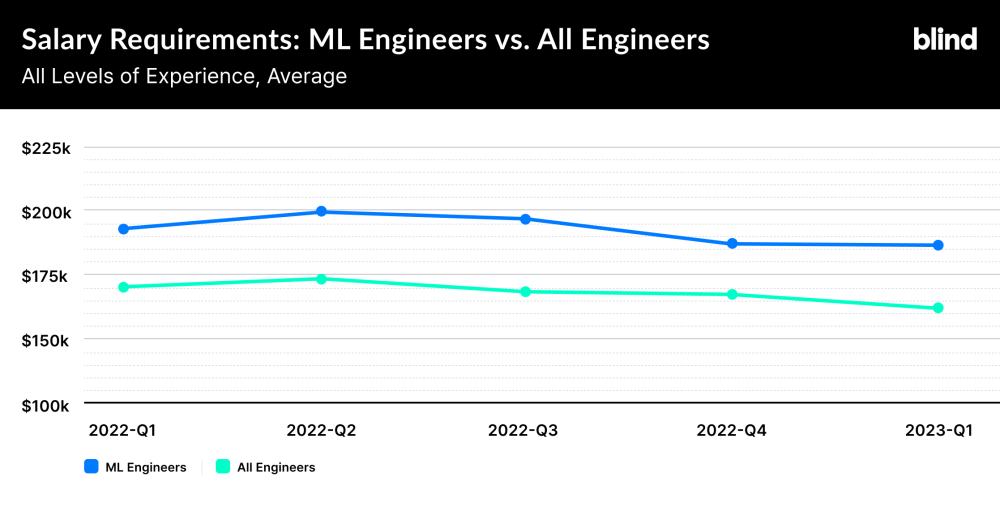

Similarly, our data also reveals that machine learning (ML) engineers’ salaries have remained the highest across various engineering roles, likely due to the recent popularity of artificial intelligence.

Entry-Level Engineers Are Least Affected by the Current Market

Employees still early in their career, with only two or fewer years of experience, were least influenced by the current job market, dropping their salary expectations only 3% year-over-year.

Interestingly, engineers in the early stages of their career, with two or fewer years of experience, have been least impacted by current market conditions. The drop in their minimum salary expectations has been modest, at 3% year-over-year decline, likely because these entry-level workers are more focused on building their resumes and establishing themselves in the industry rather than negotiating higher salaries. Furthermore, they are less likely to have as much bargaining power as their more seasoned peers.

The Job Market’s Impact on Engineers by Location and Work Environment

Engineers in Top Tech Hubs Are Hit Harder

Engineers in top metros, such as the San Francisco Bay Area, Seattle, and New York, have seen a larger drop—between 10% and 12% year-over-year, on average.

Software engineers in major tech hubs, such as the San Francisco Bay Area, Seattle, and New York, have demonstrated a large decline in salary expectations, with a median decrease ranging from 10% and an average drop of 9% year-over-year. The median refers to the salary decrease in the middle of the data set that divides it into two equal groups, with half of all engineering professionals showing a decrease larger and the other half below.

Among this group, tech workers with five to 10 years of experience have been most affected, with a year-over-year decrease of 13%, suggesting that the market conditions have had a more pronounced impact on mid-level career professionals in these highly competitive geographies.

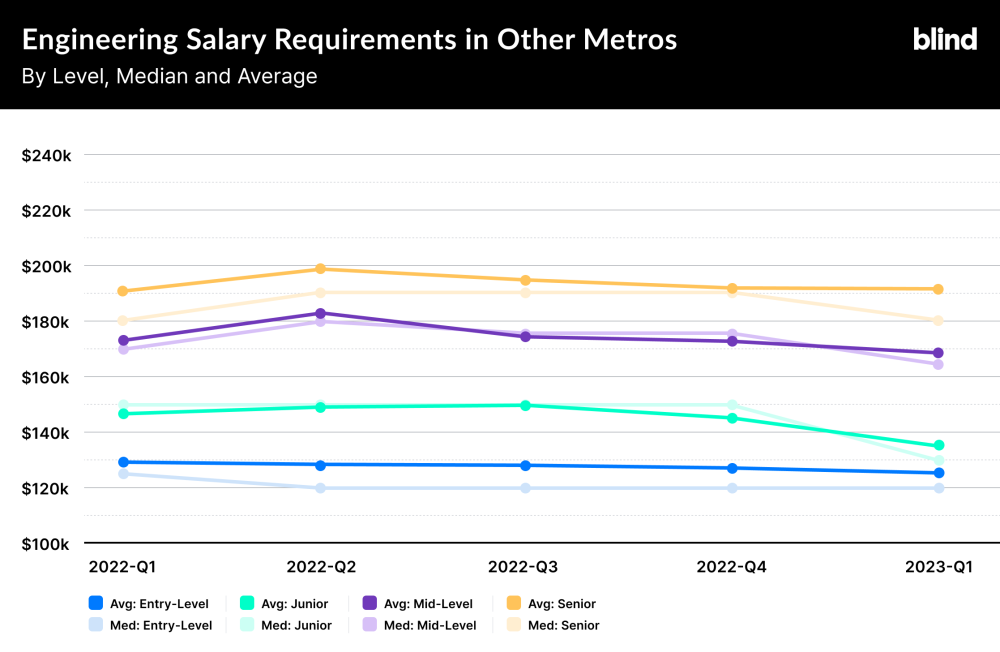

Workers Outside of Major Tech Hubs Are Showing Lesser Impact

Perhaps unsurprisingly, engineers from mid- and low-cost-of-living metros command smaller salaries, with an average of $160,163 in Q1 of 2022, compared to their counterparts in major high-cost-of-living areas, whose average minimum salary requirement was $186,218. However, the salary requirements of engineers in other metros only fell by 3% year-over-year, compared to the 9% decrease of those in top metros.

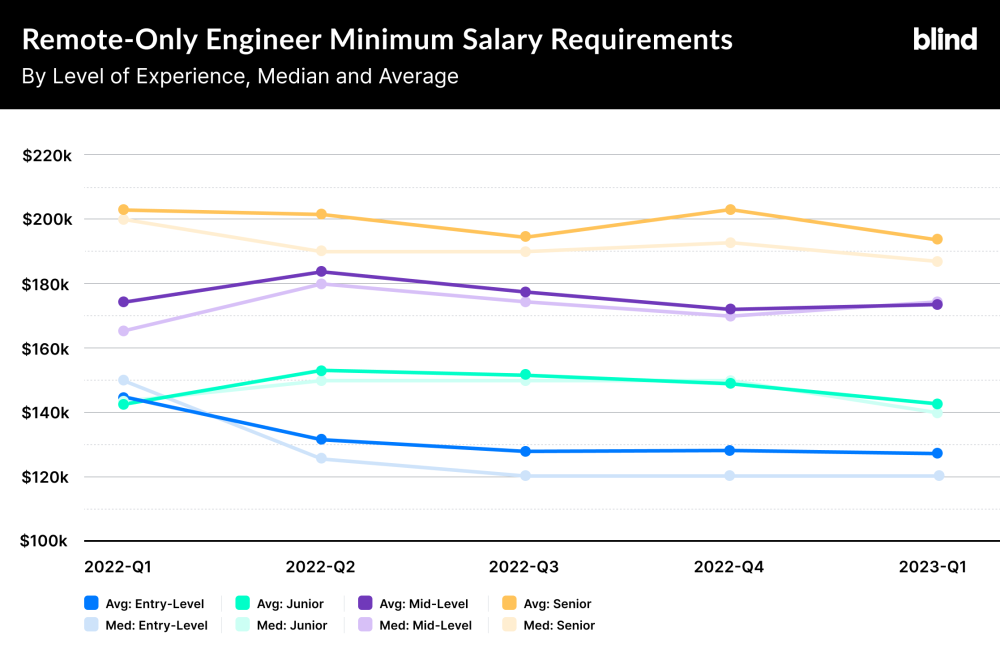

Remote Workers Have Lower Salary Expectations, but They’ve Declined Less Significantly

While engineers seeking remote-only opportunities had lower minimum salary requirements than those who preferred a hybrid work schedule or fully onsite work, the overall salary decrease for remote workers over the past year was less pronounced at 4% than the 6% drop for in-person employees. As many in-office or hybrid employees live in top tech hubs, it stands to reason that remote-first or remote-only employees’ salaries aren’t tied to their counterparts’ high cost of living standards, yielding lower, but more consistent salary expectations over time.

So what does this mean? Lattice’s Dave Carhart notes that, “The push towards pay transparency and the shift towards more remote work were already driving significant pay equalization across geography for technical roles. The downturn could accelerate that trend as candidate expectations drop fastest in the top metros.”

Gender and Salary Expectations

Mid- and Senior-Level Women Have Lower Salary Requirements Than Male Counterparts

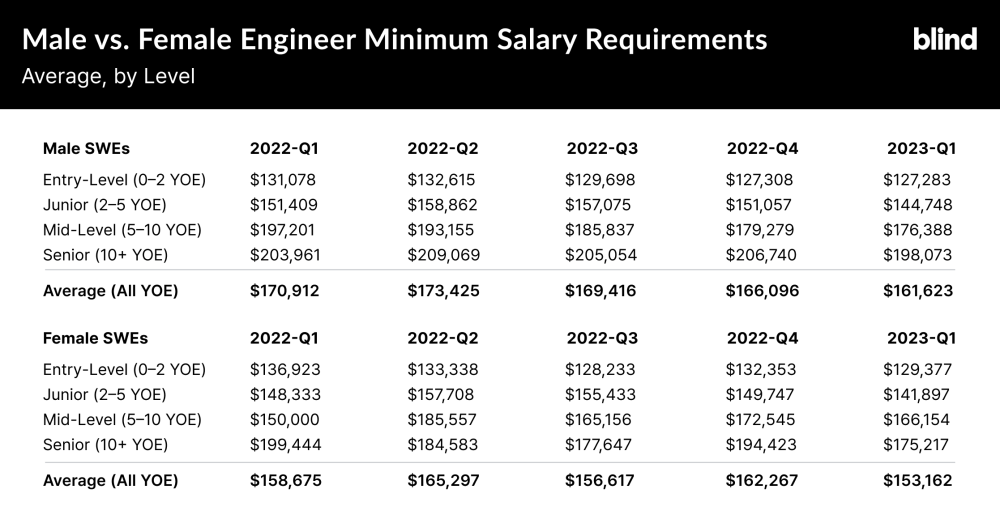

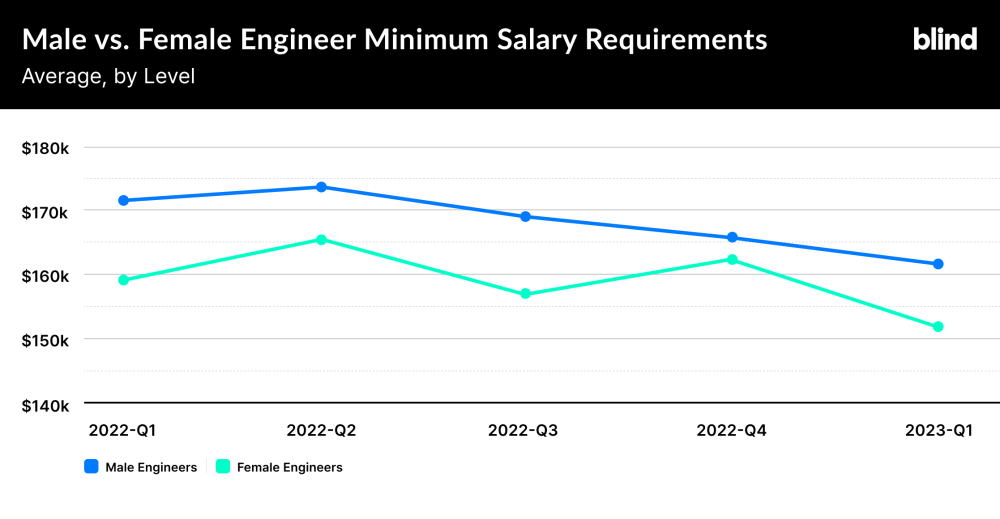

Salary requirement trends across genders and levels show similar median and average rates of decline over the past year. However, our data reveals that there’s a significant gap in the actual salary figures themselves for professionals with more than five years of experience, meaning that even at a comparable rate of decline—women are asking for (and likely earning) much lower salaries than their male counterparts.

The average minimum salary requirement for women with more than 10 years of experience dropped from $199,444 in Q2’22 to $175,217 in Q1’23, while men dropped from $203,961 to $198,073 over the same period, yielding a 12% difference in current average base salary requirements. Meanwhile, in Q1’23, mid-level women with five to 10 years of experience were 6% lower than their male counterparts, while junior female software engineers were actually 2% higher than their male peers.

This phenomenon is likely due to entry-level workers—mainly Gen Z—being more vocal about pay equity combined with the rise of salary transparency in job postings, leading to less gender pay disparity among entry-level employees. More seasoned workers, however, are still feeling the effects of the wage gap, which disproportionately affects mid-level and senior-level women.

Note: This analysis only focuses on male and female engineers, as there was insufficient data on other gender identities’ salary expectations.

Conclusion

It’s no secret that the tech industry is currently grappling with a series of formidable challenges. Nevertheless, amidst these hardships, new opportunities emerge for employers to attract top-quality candidates while still reducing costs.

By understanding the effects of evolving labor market trends, especially minimum salary requirements, we can glean valuable insights into the shifting priorities of tech professionals and devise strategies to navigate this tumultuous landscape.

The Blind survey highlights a shift in job priorities among tech workers. Most respondents are now willing to accept the same or lower pay in favor of meeting other needs, such as a preference for remote or hybrid work, increased career growth opportunities, and better company culture and work-life balance. Companies fulfilling these needs can gain a unique competitive advantage, particularly for resource-constrained startups and smaller companies.

The trends mirror the rapid shift to remote work during the COVID-19 pandemic. Such trends have long-lasting implications for the tech industry, an arena renowned for its capacity to innovate and adapt at an astonishing pace. While market conditions undeniably influence compensation through the dynamics of supply and demand, the newfound emphasis on non-monetary benefits is likely to persist. This paradigm shift underscores the need for companies to recognize the significance of these factors in attracting and retaining top talent in the tech industry.

Methodology

To gain insights, we turned to Blind, the leading anonymous professional community used by millions of tech professionals to seek and share advice. With over 85% of our approximately 8 million verified professionals—many who work as engineers or in related technical roles (e.g., data, product, etc.)—Blind is uniquely positioned to examine how these trends have affected this particular group. Blind conducted an online survey of 7,322 verified professionals in the U.S. on its platform from April 11 to 14, 2023, to understand how pay expectations might have changed in the last year.

Leveraging Blind’s talent marketplace platform, Talent by Blind, we’ve collected candidate data from over 50,000 job-seekers, providing information on salary preferences, remote work options, and demographic characteristics, among other things, over the last year. By analyzing this dataset, we gain a comprehensive understanding of the current landscape and its impact on engineering talent in the tech industry.